Vanadium seems to be making a come back and with companies like Energy Fuels, Victory Metals, and First Vanadium leading the way the question is should you invest in this earthly resource while you still have time to for potential 64x gains? Well, we answer the question today!

Thanks to Executive Order 13817 signed on December 20, 2017, Trump has signed the paper that will ensure secure and reliable supplies of critical minerals. The United States is heavily reliant on imports of certain mineral commodities which are important to the Nation’s security and economic prosperity.

Being dependent on other foreign sources creates a strategic vulnerability for both it’s economy and military to adverse foreign government action, natural disaster, and other events that can disrupt supply of these minerals.

An increase in private-sector domestic exploration, production, recycling, and reprocessing of critical minerals, and support for efforts will overall reduce dependence on imports and preserve leadership in technological innovation, support job creation and national security.

Vanadium Listed in Finalized List

The implementation will come 180 days after the publication of the list of critical minerals. After careful review, the Department of Interior finalizes the list of 35 critical minerals which include: Aluminum (bauxite), antimony, arsenic, barite, beryllium, bismuth, cesium, chromium, cobalt, fluorspar, gallium, germanium, graphite (natural), hafnium, helium, indium, lithium, magnesium, manganese, niobium, platinum group metals, potash, the rare earth elements group, rhenium, rubidium, scandium, strontium, tantalum, tellurium, tin, titanium, tungsten, uranium, vanadium, and zirconium.

Now remember this isn’t a permanent list but will be dynamic and updated periodically.

3 Stocks you Should Consider

I’ll also show you the top three small-cap stocks that will help you start profiting immediately… and give yourself a shot to 64x your money in the coming years.

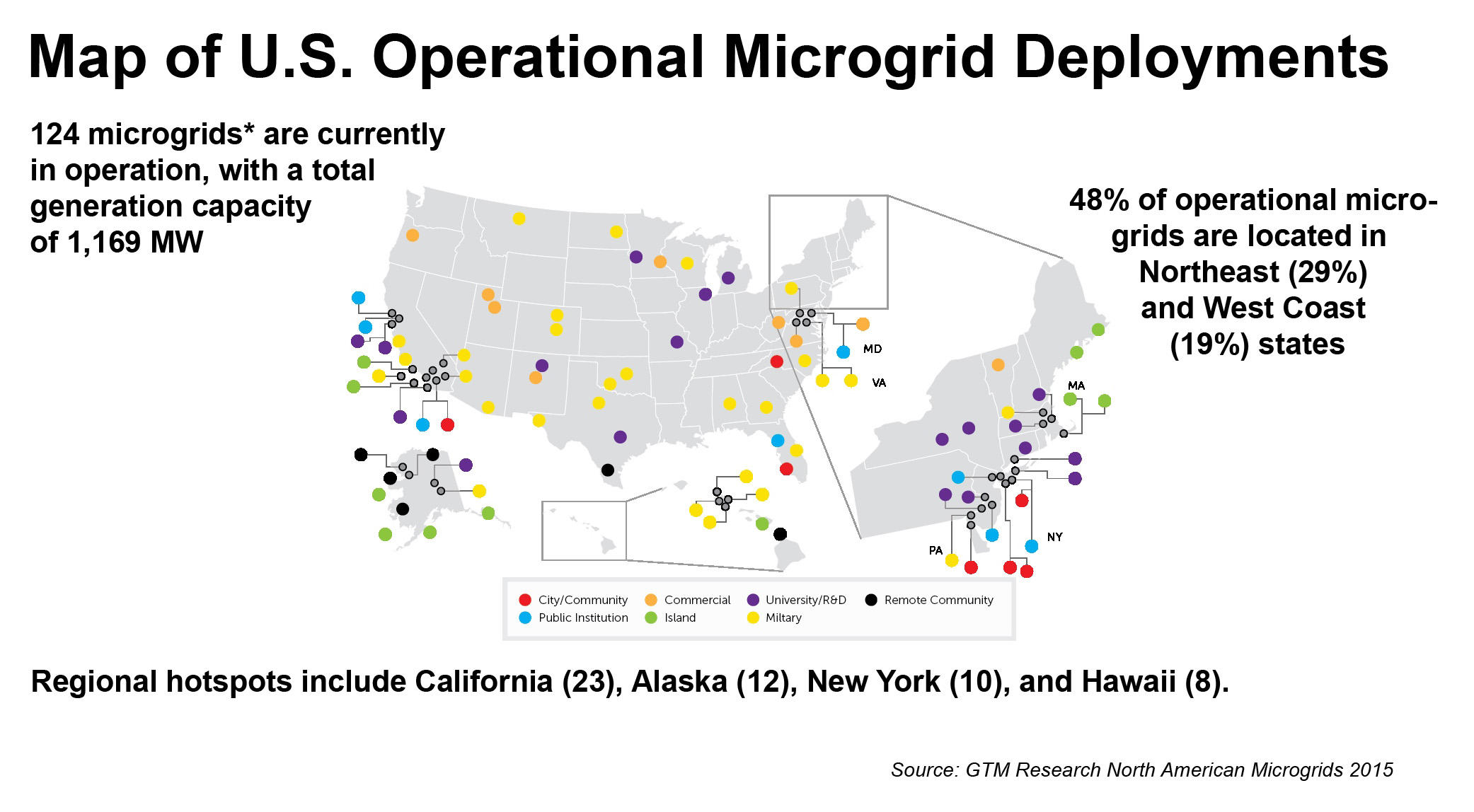

This map shows places across the U.S. where “microgrids” for electricity are being installed. These microgrids are what some insiders call “Liquid Electricity” California has even passed a law that says this protective technology must be installed on every home built after January 1, 2020.

But this is just the beginning… A 92-page Department of Homeland Security report reveals the feds’ plan to protect the entire country with this technology.

Let me sum up why this is such a big deal. Suppose it’s January and old Jack Frost is out for blood. Temperatures dip below zero. Then a cyber attack hits the grid. Instead of you turning into a human popsicle…

The Liquid Electricity in your neighborhood instantly kicks in, transmitting wattage to your community until crews can restore the grid. And if specialists can’t seem to figure out how to untangle it for days? That’s OK. There would be a warehouse full of containers that store electricity in the form of a liquid. Hence, why some call it “liquid electricity.”

It could be weeks’ worth of energy. And they could simply circulate this liquid through the cube to feed power to the community… That way, Walgreens still handles prescriptions, your water runs, and it stays warm. It’s possible because of a special metal called vanadium.

What is Vanadium?

Vanadium is a hard, silvery-grey metal that’s named after the Scandinavian goddess of beauty. The liquid used inside of these cubes is a vanadium electrolyte. This liquid changes colors as it goes through different charge states.

Executive Order 13817 officially designated vanadium as a “critical mineral” in the eyes of the U.S. government. Further, the order committed the feds to “examine Federal leasing and permitting processes to expedite access to these potential resources.” What does that mean? Simply that the government is going to put all its weight behind supporting and developing domestic vanadium mines.

That means potential loans, grants, and other federal funding – as well as fast-tracking of permits and other approvals. In short, the government is going to do everything in its power to develop all the vanadium it can find within its borders. Which is great news for a handful of stocks that are early movers in identifying, proving and developing the biggest-known vanadium deposits in the country.

First Vanadium (FVAN.V)

First Vanadium’s story began back in the 1960s – when steel giant Union Carbide discovered a new vanadium deposit during exploration work in the Carlin district in northeastern Nevada. Union Carbide conducted surface sampling and trenching at the project, and drilled 152 reverse circulation (RC) holes. This work defined a significant, near-surface vanadium deposit.

However, at the time, processing vanadium was difficult and expensive, and the company dropped the project. The Carlin project changed hands through several owners after the Union Carbide days. Despite advances in processing technology that would make it cheaper and easier to process ore from the deposit, none of them did any major work advancing the property.

This is common for low-price environments when companies simply hold claims in hope of better prices in the future. The property did see an NI 43-101-compliant resource estimate in 2010 based on the historical drill results. The NI 43-101 is a national instrument for the Standards of Disclosure for Mineral Projects within Canada.

A codified set of rules and guidelines for reporting and displaying information related to mineral properties. This yielded an inferred resource of 28 million tonnes of V2O5 averaging 0.515%, containing 289 million pounds of vanadium. The resource was classified as inferred because the past drilling was not verified by a new, modern program. Enter First Vanadium. In 2018 – seeing the potential for a big rise in the vanadium market – the company executed a deal to purchase the Carlin project and immediately began drilling in order to modernize the vanadium resource here.

The first batch of drill results confirmed the potential: Six of the eight holes hit mineralization where it was expected. Five of them returned grades higher than historical data. Some showed silver and zinc credits, which were ignored in the ’60s. Best results included 25.3 meters of 1.07% V2O5, 0.33% zinc, and 7.6 g/t silver.

First Vanadium continued to drill and found even richer zones of vanadium on the project. One drill hole, for example, returned 48.77 meters grading a muscular 1.02% V2O5. With old drilling confirmed – and new results in hand – First Vanadium then incorporated all this data into a new resource model. All told, the company tallied nearly 32 million tonnes of mineralization – containing over 375 million pounds of vanadium.

Not only was the size larger than previously identified, but the grade was higher. First Vanadium found an average grade of 0.59% V2O5, where previously the grade had been estimated at just 0.515%. All of this work confirms Carlin as the premier vanadium development project in America. Even better, it’s in Nevada – one of the easiest and quickest places on Earth to permit and build a new mine.

First Vanadium is now moving toward that goal, conducting metallurgical testing to optimize the process needed to extract vanadium from the rock at Carlin. Initial results show a lowtemperature and low-pressure version of standard pressure oxidation (POX) will work on Carlin’s vanadium ore. That’s critical, because the POX process is a low-cost way to produce vanadium.

This could make Carlin one of the most profitable producers worldwide, especially given the project is located near very good infrastructure in terms of roads and powerlines – as well as the fact most of the mineralization here is located near the surface so it’s easy to mine.

The company will have more news soon on the development of a potential mine at Carlin. I expect more investors, including larger institutions in the U.S., will get on board this story as it moves closer and closer to production.

Victory Metals (VMX.V)

I’ve been in the mineral exploration business for many years. And I can tell you that the best place on Earth to look for metals is… right next to places where big deposits have already been found.

That’s the case with Victory Metals. Like First Vanadium – which is shaping up to be America’s next and newest vanadium producer – Victory Metals also operates in mining-friendly Nevada. In fact, Victory’s Iron Point Vanadium Project is just 80 miles down Highway I-80 from First Vanadium’s Carlin property.

In many ways, I believe Victory Metals’ Iron Point project is a look-alike for First Vanadium, except that Victory is a much newer company, and far fewer investors know it – yet. Like First Vanadium’s Carlin project, vanadium was first discovered at Iron Point during the 1960s. Iron Point also saw substantial drilling that indicated mineralization here is widespread, at grades that should be profitable to mine.

The management team at Victory Metals recognized the historic vanadium results on their property, and have conducted modern work confirming that vanadium mineralization is indeed present at Iron Point. Surface trenches found vanadium over wide lengths, up to 230 meters.

Knowing it was onto something, Victory began drilling to further define the vanadium deposit here. The results have been good, such as 23 meters grading 0.63% V2O5. Victory will continue drilling and then look to estimate the total amount of vanadium it holds at the project.

After that, studies will evaluate how best to mine and sell the metal. Both of these milestones are potentially big catalysts for the stock. Another major reason to like Victory Metals is the ultra-successful management team, led by Executive Chairman Paul Matysek – a legend in junior mining with over 40 years of experience in this industry.

Paul’s got the Midas touch when it comes to building successful companies. One of them was Lithium X Energy. It went from a start-up to selling for $265 million. As CEO of Potash One, Paul oversaw the friendly takeover of his company for $434 million. And he also ran Energy Metals, a uranium company, growing it from $10 million to $1.8 billion – a 17,900% growth spurt.

Victory’s got the right people, and the right property, to prove and develop a major new vanadium deposit – and sell it at a huge profit. And there are going to be plenty of deeppocketed buyers looking to get into the vanadium space as the microgrid revolution gains steam – a perfect storm for big investment returns.

Energy Fuels (UUUU)

Energy Fuels is different from the companies above. It’s actually producing vanadium in the U.S., along with uranium. Last year, on the back of higher vanadium prices, Energy Fuels launched production of V2O5 (vanadium pentoxide) at its White Mesa Mill in Utah.

This is the only fully licensed and operating conventional uranium mill in the U.S. – and it’s 100% owned by the company. Part of this mill is now producing V2O5 from onsite stockpiles, with estimated resources of four million pounds of vanadium.

UUUU already confirmed a production rate of 200,000-225,000 pounds of V2O5 per month. The company plans to keep processing for the next 16-20 months. This will be a solid addition to the company’s revenues and production costs for this vanadium should be very low, given that the company is processing material that’s already been mined.

That’s not all… In total, Energy Fuels has 32 million pounds of V2O5 in resources across the company’s portfolio of projects. Conveniently, the entire company portfolio is located in the U.S., with 14 different deposits with vanadium credits… so the growth potential is strong.

Energy Fuels already started test-mining for vanadium at its La Sal Complex in Utah. This is targeting high-grade zones of V2O5 and selective mining to increase grade.

On the uranium side for 2019, Energy Fuels plans to produce between 50,000 and 125,000 pounds of U3O8. And if the price of uranium goes up, it could be more. The company has a solid trading volume in both the U.S. and Canada, being one of the few uranium miners with an American listing.

Last year, it even became a part of the Russell 3000 Index. The company’s financials are strong, with a large reserve of cash in the bank and manageable debt, which matures at the end of 2020. The company also holds 430,000 pounds of uranium in inventory – equal to $11 million at current prices.

This is one of the elite vanadium producers emerging in America – and is most immediately positioned to benefit from the surging market for this strategic metal.