Everyone knows what happened to NIO (NYSE:NIO) in early 2019 and while investors would like to avoid that, let’s look at how NIO is holding up.

Since NIO has received a massive beating in 2019, it may be a perfect setup for the stock to soar once again. With the easing US-China trade deal the Chinese economy and car market may see a major rebound.

NIO Outlook in the Year Ahead

According to NIO’s latest earnings report they seem to be shrinking losses and growing profits, this shows that the company is becoming more profitable and with the expected launch of a new car, that could also push sales to upward profitability.

NIO’s stock soared almost 67% on the last trading day. The reason for this is because of increased sales. These sales increased by $8 million compared to previous results and vehicle sales increase by 1,246 sold compared to previous results while expenses decreased 18%. While sales are looking to improve there are still some problems NIO needs to fix.

NIO Still Has Problems

Despite the good news and seemingly good results, NIO is still having problems and is still losing to it’s competitors. In fact, it’s financial state seems to be reaching a critical level.

Here’s what the company had to say about it’s finances:

The Company operates with continuous loss and negative equity. The Company’s cash balance is not adequate to provide the required working capital and liquidity for continuous operation in the next 12 months.

– NIO

This statement means that the company is still burning most of it’s money quarterly and must find a way to raise some funds to acquire some sort of success.

Should you invest in NIO?

No, you should not invest in NIO. I consider this a high risk play. If you’re risk tolerance is high then you can invest after thorough research on your part.

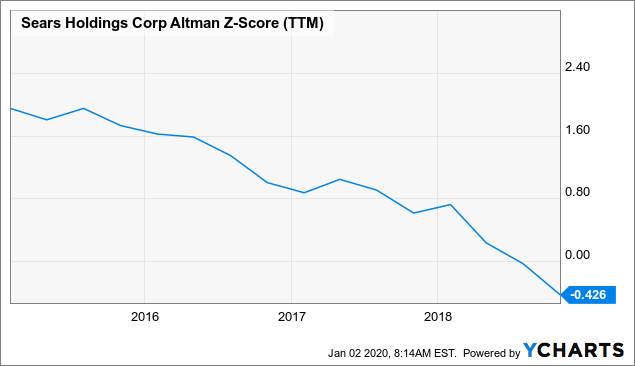

According to an analyst, the Altman Z-score of the company had an accuracy between 82% and 94% in predicting bankruptcy. A score that is 1.8 or lower says the company is headed for bankruptcy. As an example this is Sears (OTCPK:SHLDQ) that hovered around 1.8 then started deteriorating and ultimately filed Chapter 11 near the end of 2018 at around 0.7.

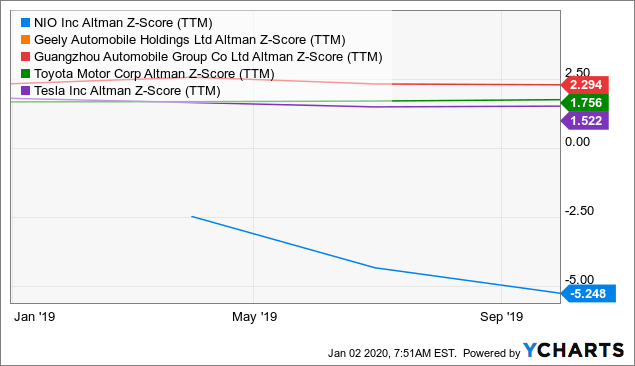

Here’s a comparison of the Altman Z-score between NIO and other EV competitors:

The analyst also believes the only way to grow into a potentially sustainable operation it will need to dilute current shareholders by a tremendous amount.

Conclusion

The recent $4+ valuation is godsent to long holders. It also looks like a very interesting point to start a short position. Although, I’d size it small as the stock is known for its off-the-charts volatility. The company is at risk of immediate bankruptcy, its valuation is in excess of Chinese peers as well as highly valued EV-peer Tesla. It is very hard to sustain long term share price appreciation because the company will need to raise a lot of additional capital to continue as a going concern – let alone to grow to a company of a potentially profitable and sustainable size.